It enhances the power to organize and analyze monetary statements in accordance with GAAP, a requirement for CPA positions. You cowl Financial assertion evaluation, especially comparative, which correlates with US CMA half 1 syllabus, particularly, Monetary Planning, Performance and Analytics. And that data helps candidates assess funds, see how operating efficiency has diversified over time and help strategic planning. Such analysis results in administration determination support with informative year on 12 months monetary comparability.

Comparative Monetary Statement :Varieties, Evaluation & Objectives

We can also use the financial ratios derived from the steadiness sheet and examine them historically versus industry averages or opponents. The comparative monetary statement has advantages like straightforward comparability, observing the trend, periodic efficiency analysis, and so on. Nonetheless, it has disadvantages like ignoring inflationary impact, excessive dependability on monetary info that might be manipulated, use of a unique technique of accounting by varied entities, and so forth.

These financial statements assist people determine a business’s profitability, liquidity, and solvency position. Furthermore, they permit one to match monetary figures from at least two accounting periods. People can also determine the strengths and weaknesses of an organization and compare its efficiency against different companies in the industry by preparing this statement. Comparative financial statements play a pivotal role in financial reporting, offering a useful snapshot of an organization’s efficiency over totally different intervals.

Analyzing Horizontal And Vertical Evaluation

Finding Out the percentages on the stability sheet could lead to a number of different observations. For occasion, if there was a 6.9% decrease in long-term debt signifies that curiosity charges will be lower in the future, having a positive impact on future internet earnings. An improve in retained earnings could possibly be a sign of elevated dividends sooner or later; in addition, the rise in cash of 19% might help this conclusion. Horizontal evaluation is called horizontal as a outcome of we have a glance at one account at a time across time.

- Many traders consider the money move statement the most important indicator of a company’s performance.

- Benchmarking can be thought of a tool for improvement with customer-oriented actions driven by customer and inner group wants.

- These metrics assist assess the effectivity and profitability of your small business operations, allowing you to take control and make necessary changes to enhance overall monetary efficiency.

- On the other hand, an analyst might even see the price of gross sales development and conclude that the upper prices make the company much less enticing to buyers.

Once all of that is calculated, you have to write or explain what those results mean. Figuring Out these areas for enchancment via monetary ratios evaluation empowers you with the information needed to develop efficient strategies for development and success in your business. Let us look at the following factors to understand the significance of those monetary statements. All public corporations in the U.S. must publish these monetary statements in 10-Q and 10-K reviews to satisfy the requirement of the Securities and Trade Fee or SEC. The debt-to-equity ratio and the interest protection ratio are two commonly used solvency ratios. The debt-to-equity ratio measures an organization’s complete debt relative to its shareholders’ equity.

Evaluating Revenue Statements With Comparative Approaches

One of the primary causes for monetary evaluation is to evaluate the efficiency of a business. By analyzing financial statements, businesses can gain a greater understanding of their profitability, liquidity, and solvency. This information https://www.simple-accounting.org/ can be utilized to identify areas where the enterprise is performing nicely, as nicely as areas the place improvements could be made. For instance, if a enterprise has a low profitability ratio, monetary analysis can help identify areas the place prices can be decreased or where income may be increased.

Buyers, creditors, and regulatory businesses usually focus their evaluation of monetary statements on the corporate as a complete. Since they can not request special-purpose reports, external customers must depend on the general-purpose monetary statements that corporations publish. These statements include a steadiness sheet, an income statement, a statement of stockholders’ fairness, a press release of cash flows, and the explanatory notes that accompany the monetary statements.

This doc enables buyers to identify developments, monitor a company’s progress, and examine it with business rivals. Comparative statements typically include income statements, balance sheets, and cash circulate statements. While helpful for recognizing developments, they can be less reliable during times of significant change, similar to mergers or accounting policy shifts. Income statements provide priceless insights into the monetary health and efficiency of your corporation. By conducting tendencies evaluation on the income assertion, you’ll find a way to determine patterns and changes in revenue and bills over time.

To evaluate them, one must prepare their financial assertion in absolute formats bringing all the particulars. The globally acceptable form to reveal the financials for comparison is to bring data in a percentage format. The group will prepare major monetary statements like monetary statements like common measurement steadiness sheet, and common-size money circulate assertion. Total, incorporating comparative financial statements into your decision-making course of empowers you with useful insights that can guide strategic choices and improve monetary performance evaluation. Don’t underestimate the power of these statements in serving to you make knowledgeable decisions that will drive success for your business.

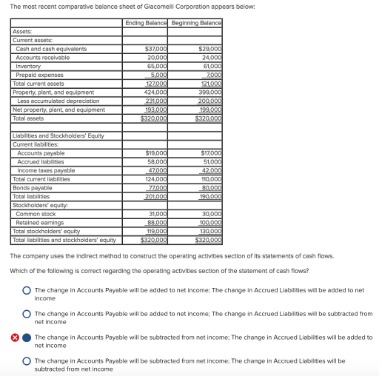

Comparative statements current past and current financial data side by side, serving to investors and analysts observe trends, assess performance, and compare companies within an trade. Required by the SEC in 10-K and 10-Q filings, they promote transparency and reveal insights into cash flow, prices, and total financial well being. An example of comparative financial statements can be a company’s income assertion for the previous three years introduced facet by side. This would enable for a comparison of revenue, expenses, and profitability over the three-year period. This analysis performs a vital role in identifying trends, patterns, and potential dangers or alternatives that may have emerged.